Why Is Having Vehicle Insurance While On The Road Considered A Smart Move

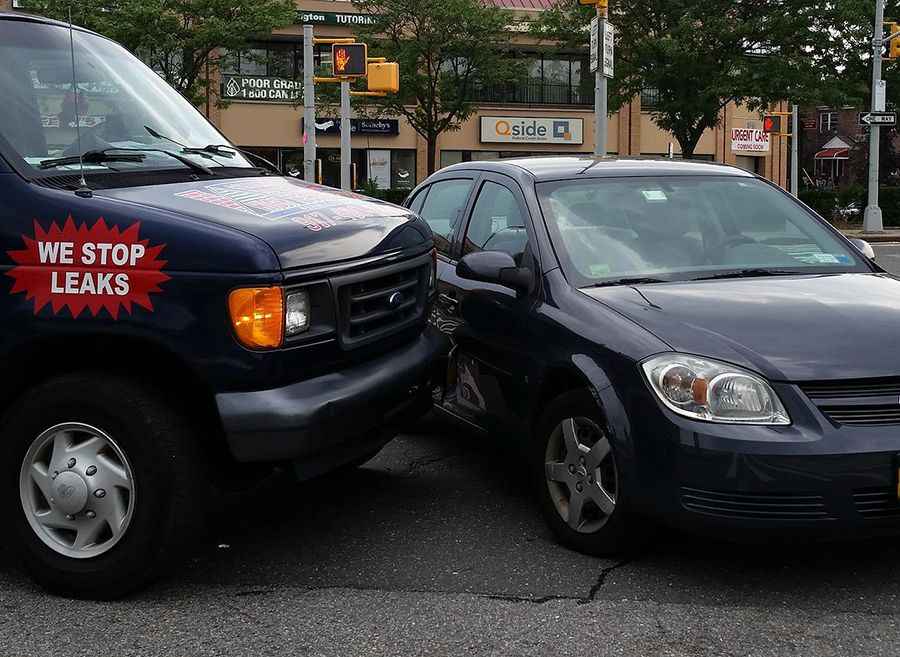

There are many reasons why having vehicle insurance while on the road is considered a smart move. One of the most important reasons is that it can help protect you financially in the event of an accident. If you are involved in an accident and you do not have insurance, you could be held liable for any damages that occur.

This could end up costing you a lot of money. In addition, having insurance can also help protect your assets. If you are involved in an accident and do not have insurance, your assets could be seized to cover any damages.

Is Car Insurance Required?

Most states require drivers to have some form of car insurance. However, the type and amount of coverage required vary from state to state. Even if your state does not require you to have car insurance, it is still a good idea to purchase at least the minimum amount of coverage. This will help protect you financially in the event of an accident. For instance, auto insurance is required and can be gotten from a [trusted P&C agent or broker.

What Does Car Insurance Cover?

Car insurance typically covers two things: liability and collision. Liability coverage helps pay for any damages that you may be held liable for if you are involved in an accident. This includes property damage and bodily injury. Collision coverage helps pay to repair or replace your vehicle if it is damaged in an accident.

There are many different types of car insurance coverage available. The type of coverage you need will depend on a number of factors, including the value of your vehicle and your driving record. You should speak with an insurance agent or broker to determine the best coverage for your needs.

How Much Auto Insurance Do I Need?

The amount of auto insurance you require will be determined by a variety of criteria, including the value of your vehicle, your driving record, and state requirements. To find the optimum coverage for your needs, consult with an insurance representative or broker.

Why Is Having Vehicle Insurance While On The Road Considered A Smart Move?

There are many reasons why having vehicle insurance while on the road is considered a smart move. For one, it can help you financially in the event of an accident. If you cause an accident, your insurance can help pay for the other driver's damages. Secondly, if you are in an accident that wasn't your fault, your insurance can help pay for your own repairs. For example, if you are hit by an uninsured driver, your insurance can help pay for the repairs to your vehicle. Thirdly, insurance can provide peace of mind in knowing that you are covered in the event of an accident. This means that you can focus on driving and not worry about the financial consequences of an accident. Fourthly, having insurance can help you avoid legal troubles. If you are involved in an accident and do not have insurance, you may be sued by the other driver. Finally, having insurance can help you get back on the road after an accident. If your vehicle is damaged in an accident, your insurance can help pay for the repairs so that you can get back on the road as soon as possible. All of these reasons show why having vehicle insurance while on the road is such a smart move.

Cashless Garage Network

One of the best features of having a motor insurance policy is the cashless garage network. This allows you to get your car repaired at any of the partner garages without having to pay anything out of your pocket. The insurance company will directly settle the bill with the garage. This is a very convenient feature as it saves you a lot of time and hassle.

No Claim Bonus

If you have not made any claims during your policy period, you are eligible for a no-claim bonus (NCB). This is a discount that the insurance company offers on the renewal premium. The NCB can go up to 50% of the premium amount. This is a great way to save on your motor insurance premium.

Customization Through Add-Ons

Nowadays, motor insurance policies come with a host of add-ons that you can choose from to customize your policy. Some of the popular add-ons are engine protector, roadside assistance, return to invoice cover, etc. These add-ons provide additional protection and coverage at a nominal cost. Protector is a very useful add-on if you live in an area that is prone to floods or riots as it covers the cost of repairs due to these natural disasters. Roadside assistance is a very handy add-on as it provides you with 24x365 support in case your car breaks down in the middle of nowhere. Return to invoice cover is an add-on that covers the difference between the insurance payout and the showroom price of your car in case it is declared a total loss. You can choose the add-ons as per your requirements. This means that you only pay for the coverage that you need.

Overall, there are many reasons why having vehicle insurance while on the road is a smart idea. These are some of the many reasons for doing it. Insurance provides financial protection in the event of an accident and also offers peace of mind. So, even though you are a good driver, you should think about it as you never know what can happen. It is important to choose the right policy and customize it as per your requirements. So, make sure you have adequate vehicle insurance while on the road. It could prove to be a very smart move. So, get insured today!