Factors to consider when choosing a car loan

If you are looking for a reliable and affordable car, chances are you will need to finance your purchase. Whether you're getting a car loan for the first time or not, it's important to consider all the factors that go into choosing the right car loan, so you don't have to read the pros and cons of refinancing car as an option later.

From loan terms and monthly payments to interest rates and credit requirements, there’s no shortage of things to think about when making such an expensive commitment.

Here we will go over some of the main considerations when picking out a car loan so that you can ensure that you make smart decisions before signing on the dotted line.

Understand the basics of car loan terms

Delving into the world of car loans can be overwhelming, especially for first-time borrowers.

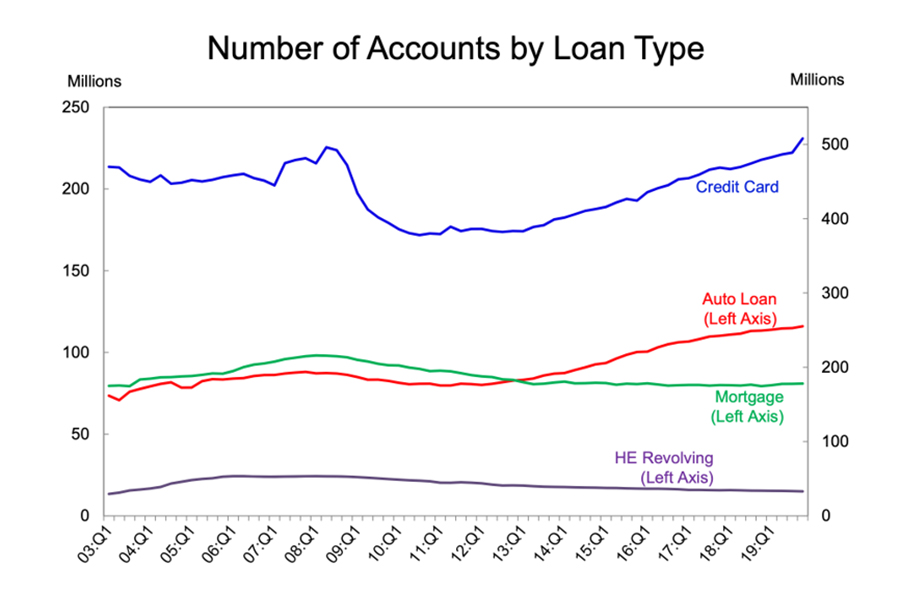

According to the New York Fed Consumer Credit Panel, car loans are extremely popular among other loan types that prove the trustworthiness of customers.

Grasping the fundamentals of car loan terms is essential for making informed financial decisions and ultimately securing a suitable loan to finance your dream vehicle.

Car loan terms refer to the length of time over which you repay the borrowed amount (principal) along with interest. Such loan terms generally range between 36 and 72 months. It's crucial for borrowers to understand that with a longer loan term, while their monthly payments may be lower, the overall interest paid will be significantly higher.

Consequently, opting for the shortest term that aligns with your budget can save you a significant amount in interest payments. By understanding the basics of car loan terms, you will be well-equipped to select the best possible option tailored to your financial needs and achieve a smooth journey toward car ownership.

Research interest rates before signing a contract

Getting familiar with the interest rates landscape is a crucial step one must take before deciding to commit to a contractual agreement, be it for loans, mortgages, or any financial arrangement.

Taking the time to research this important aspect will save you from unforeseen financial blunders and ensure that you get the best deal tailored specifically to your needs.

By comparing prevailing rates, understanding the distinction between fixed and variable rates, and evaluating your financial situation, you will be empowered to make well-informed decisions. Ultimately, possessing full knowledge of interest rates and their implications will safeguard your financial future and provide you with a sense of security throughout the duration of the contract.

Calculate the total cost of the loan over its term

Calculating the total cost of a loan over its term is an essential task for any borrower, helping them to determine the affordability and overall long-term financial implications of taking out a loan.

To achieve this, it is critical to consider factors such as the principal amount, interest rate, loan term, and additional fees or charges associated with the loan. By carefully evaluating each of these components and using financial tools, such as loan calculators, borrowers can gain a comprehensive understanding of the full scope of their financial commitments over the lifetime of the loan.

This in-depth knowledge will empower them to make informed financial decisions, paving the way for a more stable and secure financial future.

Figure out what monthly payment is doable for your budget

Determining a feasible monthly payment that fits within your budget is essential in managing your finances and ensuring financial stability. To do so, taking a comprehensive look at your income, expenses, and financial goals is crucial.

Start by tallying up your total monthly income and available funds,includinge all your income sources. Next, consider your fixed and variable expenses, such as housing costs, utilities, groceries, and transportation.

Subtract these expenses from your income to ascertain the amount left for discretionary spending and savings. It's important to set aside a portion of your remaining funds for emergency savings and future financial goals is important.

Once you have allocated funds for these priorities, the remaining amount can be used to determine a manageable monthly payment that aligns with your budget commitments while still allowing you to maintain a comfortable lifestyle.

Consider the pros and cons of balloon payments

Balloon payments can be an attractive option for borrowers seeking to minimize their monthly payments while obtaining a loan. By deferring a significant portion of the loan principal to the end of the loan term, borrowers enjoy lower monthly installments throughout the loan.

This can be particularly advantageous for those expecting a financial windfall, such as an inheritance or bonus, in the future. However, balloon payments also come with potential risks. The large lump sum due at the end of the loan term can create a financial burden if borrowers are unable to save or secure funds to meet this obligation.

Additionally, relying on a future windfall can be unpredictable, as life circumstances may change, affecting one's ability to make the balloon payment as planned. Thus, those considering balloon payments need to carefully assess their financial situation and weigh the potential benefits and drawbacks before making a decision.

Compare different car lenders and their repayment terms

Navigating the landscape of car lenders can be a challenging endeavor, particularly when seeking the repayment terms that best align with your unique financial needs. However, a well-informed comparison of various lenders can make all the difference in tailoring an auto loan to your specific situation.

Begin by exploring interest rates offered by different lenders, such as banks, credit unions, and online platforms, keeping in mind your credit score's impact on these rates. Thankfully, there are also bad credit car loans available that can help those with less-than-perfect credit secure financing, so be sure to explore all options. Next, dive into the loan terms themselves, evaluating factors like loan period length, early repayment penalties, and options for refinancing down the line.

By diligently conducting this comparative research, you hold the key to confidently securing an auto loan that fits like a glove, ensuring a smooth, satisfying experience as you cruise through the car-buying process.

Conclusion

In conclusion, the decision to find the right car loan is an important one to make. Before signing on the dotted line, it’s essential to understand car loan terms, research interest rates, note the total cost of the loan over its term, decide what monthly payments you can afford, and ascertain if a balloon payment is a viable option.

Taking all these factors into account, make sure to compare different lenders and their repayment terms in order to determine which one best suits your needs. By following this advice, you can be more informed when it comes to acquiring a car loan.